# Budget 2014 Highlights:

When Arun Jaitley reads out his annual Union Budget on Thursday, it

could well be the constructive road map the NDA government lays out to

bring the "Acchhe din" it has promised the nation. The state of

the economy of India is deplorable though it looks quite solid when

compared to many other countries in the world. Jaitley needs to handle

taxation issues, social sector schemes, rationalize its subsidies

without affecting the poorest, and revive growth in the economy. The

expectations from the Budget is huge. Though many of our problems cannot

be fixed in a year, this Budget has to lay out the vision of the

government for the nation.

Service Tax: Minimal changes.Negative list: Sales of space for

advertisements on online.Newspapers will remain exempted.Tourism to be

boosted for change in service tax.

Indirect Taxes :

Customs duty:

Reduced basic customs duty for some industries with varying rates.

LCD and LED TV prices below 19 inches to go down.

Coal customs duty changed to reduce disputes regarding quality of coal

Indirect Taxes :

Customs duty:

Reduced basic customs duty for some industries with varying rates.

LCD and LED TV prices below 19 inches to go down.

Coal customs duty changed to reduce disputes regarding quality of coal

Excise duty:

Tweaked to boost domestic production.

Concessional 2% benefit to sports clubs.

Cigarettes, Pan Masala, Gutka, chewing tobacco: Price to go up by hiking duty.

Additional duty of excise on aerated waters containing added sugar.

Reduced duty in footwear, packaged food.

Income out of portfolio: capital gains.

Long term foreign borrowing: eligible date from 31.6.2016 to 20.6.2017: concessional rate of 5% for interest payments. All bonds, not just infrastructure bonds.

Provide investment allowance at 15% for 3 years to the manufacturing company which invests more than Rs 25 crore in plant and machinery.

Concessional 2% benefit to sports clubs.

Cigarettes, Pan Masala, Gutka, chewing tobacco: Price to go up by hiking duty.

Additional duty of excise on aerated waters containing added sugar.

Reduced duty in footwear, packaged food.

Power:

10 year tax holiday for new generators or distributors.Income out of portfolio: capital gains.

Long term foreign borrowing: eligible date from 31.6.2016 to 20.6.2017: concessional rate of 5% for interest payments. All bonds, not just infrastructure bonds.

Transfer Pricing:

Range concept for determination of arms length price.Provide investment allowance at 15% for 3 years to the manufacturing company which invests more than Rs 25 crore in plant and machinery.

Direct Tax Code:

Govt will review and take a decision. Previous proposal lapsed with dissolution of Lok Sabha.Non plan expenditure:

Rs 1219892 crore.Taxation

Direct tax: retain interim budget targets. Rs 13,64,524 cr tax receiptsIntroduce measures to promote manufacturing

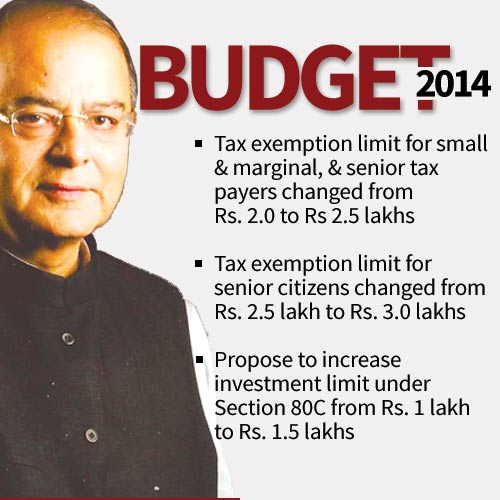

Individual: No changes in tax rate

Increase personal exemption increased by Rs 50000.

Senior citizens: moved up to Rs 3 lakh

No change in surcharge rate

Education cess: remain 3%

Savings at 30.1% in 1013. Increase in savings required.

Investment limit under 80C increase to Rs 1.5 lakh

Housing loan: Rebate hiked to Rs 2 lakh for self occupied houses.

Andhra Pradesh-Telengana: Provisions to help both states.

60 more Ayakar Sewa Kendras to be set up across the country.

Rs 10000 crore extra to build railways in North East over and above Interim Budget.

Displaced Kashmiri migrants: Rs 500 crore for rehabilitation.

Himalayan studies: National centre in Uttarakhand with initial outlay at Uttarakhand.

North East: organic farming development: Rs 100 crore

Sports

Jammu & Kashmir: special sum of Rs 200 crore to upgrade indoor and outdoor stadiumsSports University in Manipur: Rs 100 crore

International events to be held in North and North East India

Rs 100 crore for training of sports persons for Asian Games

Young leader's programme: Rs 100 crore

Rivers

Serious effort to link rivers. Sets aside Rs 100 crore for a report.Substantial money spent to clean Ganga.

Integrated Ganga Conservative Mission: Rs 2037 crore for it

Rs 100 crore for Ghat development.

2 clusters for research in Kolkata and Pune.

Rs 100 crore for Ghat development.

Science and technology

Turn 5 centres into research instituions. PPP model.2 clusters for research in Kolkata and Pune.

Long term foreign borrowing: eligible date from 31.6.2016 to 20.6.2017: concessional rate of 5% for interest payments. All bonds, not just infrastructure bonds.

Transfer Pricing: Range concept for determination of arms length price.

Provide investment allowance at 15% for 3 years to the manufacturing company which invests more than Rs 25 crore in plant and machinery.

National Industrial corridor with headquarter in Pune

SME: Bulk of service sector also SMEs. Majority run by SC ST OBC. Financing is important. Need to examine financial architecture of this sector. Set up committee to give suggestion in 3 months.Venture capital in SME: Rs 10,000 crore fund. To attract other investors.

Apprentice Act to be suitably amended to strengthen the Apprentice Training Scheme.

All the Govt departments and ministries will be integrated through E-platform by 31 Dec this year.

16 new port projects this year.

Agriculture sector

Fertilser- must take care of degradation of soil.Inititial fund of Rs 100 crore for climate change fund.Farmers bank lending: Propose to produce of Rs 5 lakh to Bhumeeheen Kisan groups through NABARD.

Price stabilisation fund introduced.

Food, oil subsidies to be more targeted.

Indigenous cattle breeding to be supported.

Banks: target of Rs 8,00,000 crore to lend to agriculture sector.

Short term crop loan: Farmers to get further incentive of 3% for farmers who pay on time.Was already getting loan at 7%.

Raise RIDF corpus by Rs 5000 crore. Target of Rs 25000 crore set by Chidambaram.

Rs 5000 crore for infrastructure fund in agriculture.

Long term rural credit bank to provide support to cooperative banks and RRBs, by NABARD.

Rs 5000 crore allocated.

Producer's development fund to get Rs 200 crore in NAABARD.

Govt will undertake open market sales to keep prices under control.

Farmers to get information on new techniques. Rs 100 crore set aside.

Use of recycled water, solid waste management, see drinking water: hubs using PPP model to be set up

Rs 100 crore: Metro project in Lucknow

Propose to set up 5 new IIMs in HP, Punjab, Bihar, Odisha & Maharashtra:

Low cost housing: Rs 4000 crore for National Housing Bank

Slum development to be part of CSR.

Currency notes to have braille.

Rs 200 crore for 4 agricultural institutes in 4 states

Rs 100 crore has been allocated for the modernization of Madrasas.

Universal healthcare: 4 more AIIMS in Andhra Pradesh, West Bengal, Vidharbha,Purvanchal. Rs 500 crore set aside.

12 more medical colleges in government hospitals.

Aim to create AIIMS in every state of the country

Rs 3650 crore for safe drinking water.

Toilets and drinking water in all girls' school to begin with. More than Rs 26000 crore set aside

Under the 'Pradhanmantri sadak yojna' propose 14,389 cr for development of roads

Senior citizens: Additional pension introduced by NDA govt last time.

Unclaimed amount of PPF etc. Mostly out of investments belonging of senior citizens. Set up a committee to protect senior citizens. report by December 2014.

EPFO to launch unified accounts to transfer PF funds.

Minimum pension of Rs 1000 per month. Initial fund of Rs 250 crore.

Differently abled persons: Make inclusive opportunities. Centre for sports for differently abled

Visually challenged: 15 new braille press.

Women's safety: Rs 50 crore to be spent by Roads ministry to increase safety of women on roads: Pilot project

Beti bachao Beti padhao Yojana: Apathy towards girl child rampant. Rs 100 crore allocation.

NREGA: Rural SHGs extend 4% loans to more rural areas. NREGA to target more productive work.

National Housing programme: Rs 8000 crore

Banking: Disinvestment to retail investors to collect money. To give greater autonomy to banks.

PSU capital expenditure: Rs 2, 47,000 crore.

Urbanisation: Need to develop new cities. Provides Rs 7060 crore.

E Visas: To facilitate visa on arrival

Infrastructure Investment Trust to help infrastructure projects.

Kisan Vikas Patra: To have bank and non-bank savings for farmers.

Bulk of farm lands are rain fed. Must improve irrigation. Sets aside Rs 1000 crore for this.

Sanitation: Rural sanitation to reach of every household.

Power: Dindayal Upadhyay Gram Jyoti Yojana launch: Rs 500 crore set aside

11:25 ISTThursday, 10 July 2014

Litigation in direct tax: Resident to have possibility of getting advanced order on tax liability.

FDI: Allow selectively in sectors. India needs a push for job creation. We are buying substantial portion of defence requirement.

Insurance sector: Increases FDI to 49% from 265 currently.

Promoted to minimum government and maximum governance.

Govt will form commission to review expenditure.

Urea policy will be reformulated.

GST essential to restructure taxation. I assure all states govt will be more than fair to all states.

Retrospect taxation: No change to be brought in retrospectively. Govt will be extremely cautious.

Jaitley says the people below poverty line wants to raise themselves above it. While higher growth is important, we cannot ignore that the poor suffer the most.

The government has taken up the challenge in right earnest. The task is challenging because we need to revive manufacturing and infrastructure sector. We need to introduce fiscal prudence. We cannot spend to day which is compensated by tax in future.

Must improve tax-GDP ratio.Although the external sector witnessed turn around and CAD improved, it was through restriction on non-essential imports.

Producer's development fund to get Rs 200 crore in NAABARD.

Food Sector

Need to restructure FCI.Govt will undertake open market sales to keep prices under control.

Farmers to get information on new techniques. Rs 100 crore set aside.

E-based platforms:

FTII Pune, SRFTI Kolkata: Special status of national importance.Use of recycled water, solid waste management, see drinking water: hubs using PPP model to be set up

Rs 100 crore: Metro project in Lucknow

Propose to set up 5 new IIMs in HP, Punjab, Bihar, Odisha & Maharashtra:

Low cost housing: Rs 4000 crore for National Housing Bank

Slum development to be part of CSR.

Currency notes to have braille.

Rs 200 crore for 4 agricultural institutes in 4 states

Rs 100 crore has been allocated for the modernization of Madrasas.

Universal healthcare: 4 more AIIMS in Andhra Pradesh, West Bengal, Vidharbha,Purvanchal. Rs 500 crore set aside.

12 more medical colleges in government hospitals.

Aim to create AIIMS in every state of the country

Rs 3650 crore for safe drinking water.

Toilets and drinking water in all girls' school to begin with. More than Rs 26000 crore set aside

Under the 'Pradhanmantri sadak yojna' propose 14,389 cr for development of roads

Budgetory Allocations

Rs 50548 crore for SC-ST plan.Senior citizens: Additional pension introduced by NDA govt last time.

Unclaimed amount of PPF etc. Mostly out of investments belonging of senior citizens. Set up a committee to protect senior citizens. report by December 2014.

EPFO to launch unified accounts to transfer PF funds.

Minimum pension of Rs 1000 per month. Initial fund of Rs 250 crore.

Differently abled persons: Make inclusive opportunities. Centre for sports for differently abled

Visually challenged: 15 new braille press.

Women's safety: Rs 50 crore to be spent by Roads ministry to increase safety of women on roads: Pilot project

Beti bachao Beti padhao Yojana: Apathy towards girl child rampant. Rs 100 crore allocation.

NREGA: Rural SHGs extend 4% loans to more rural areas. NREGA to target more productive work.

National Housing programme: Rs 8000 crore

Banking: Disinvestment to retail investors to collect money. To give greater autonomy to banks.

PSU capital expenditure: Rs 2, 47,000 crore.

Urbanisation: Need to develop new cities. Provides Rs 7060 crore.

E Visas: To facilitate visa on arrival

Infrastructure Investment Trust to help infrastructure projects.

Kisan Vikas Patra: To have bank and non-bank savings for farmers.

Bulk of farm lands are rain fed. Must improve irrigation. Sets aside Rs 1000 crore for this.

Sanitation: Rural sanitation to reach of every household.

Power: Dindayal Upadhyay Gram Jyoti Yojana launch: Rs 500 crore set aside

11:25 ISTThursday, 10 July 2014

Litigation in direct tax: Resident to have possibility of getting advanced order on tax liability.

FDI: Allow selectively in sectors. India needs a push for job creation. We are buying substantial portion of defence requirement.

Insurance sector: Increases FDI to 49% from 265 currently.

Promoted to minimum government and maximum governance.

Govt will form commission to review expenditure.

Urea policy will be reformulated.

GST essential to restructure taxation. I assure all states govt will be more than fair to all states.

Retrospect taxation: No change to be brought in retrospectively. Govt will be extremely cautious.

Jaitley says the people below poverty line wants to raise themselves above it. While higher growth is important, we cannot ignore that the poor suffer the most.

The government has taken up the challenge in right earnest. The task is challenging because we need to revive manufacturing and infrastructure sector. We need to introduce fiscal prudence. We cannot spend to day which is compensated by tax in future.

Must improve tax-GDP ratio.Although the external sector witnessed turn around and CAD improved, it was through restriction on non-essential imports.

Rate the budget-2014 according to your benefits.Give merits and

de-merits to the budget.Share your reviews in the comment section below.

Source :- http://www.indiaforbes.com/2014/07/highlights-of-budget-2014-big-hope-for.html

0 comments:

Post a Comment